Specialty Materials

From KAITEKI Report 2023 issued in September 2023

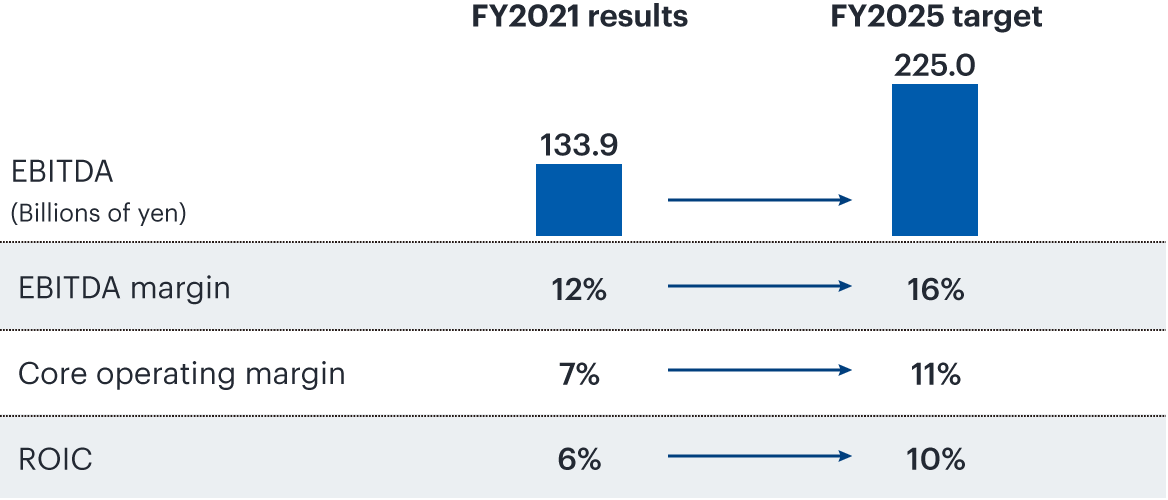

MCG Group’s engine for profitable growth

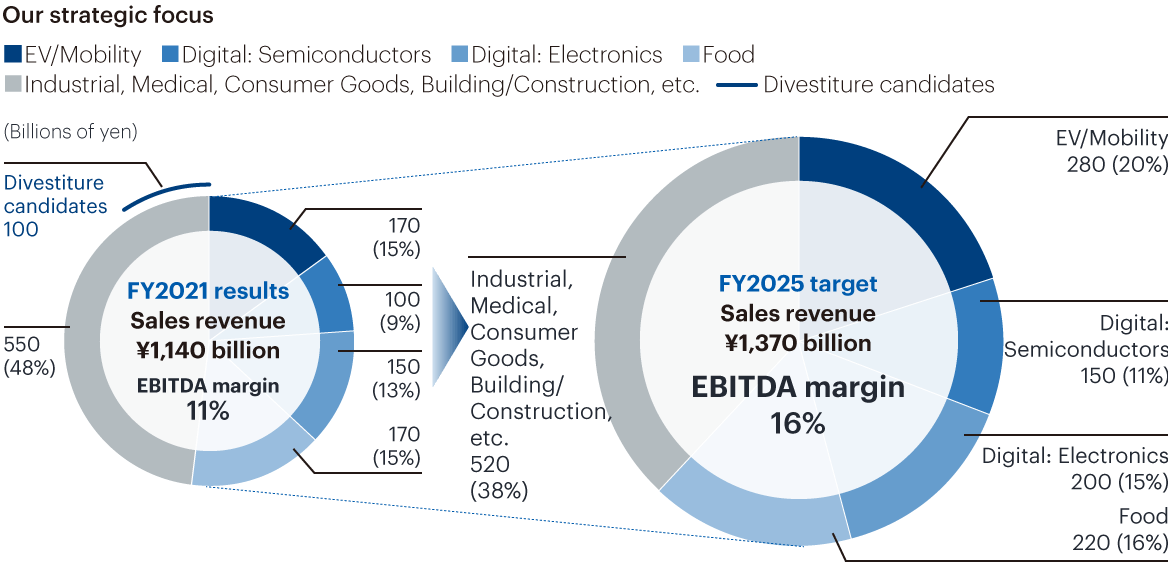

In the Specialty Materials business, we will achieve sales growth and improved profit margins through fiscal 2025 by executing three key strategies in line with the growth, performance, and sustainability pillar. We have defined EV/Mobility, Digital, and Food as our strategic focus because we expect particularly strong growth in these markets. We aim to grow our businesses at a rate commensurate with market growth. We will transform the Mitsubishi Chemical Group into a specialty materials group by strengthening the position of our products in markets where growth is expected, developing our businesses globally, and stepping up innovation to solve sustainability issues.

Strategic focus

- Move from product-focused to market-oriented organization

- Grow existing products globally

- Build leadership positions in sustainability areas

SWOT analysis

Strengths

Strengths

- EV/Mobility

High-performance engineering plastics: Global network of businesses capable of handling operations from plastic production to molding and processing

Electrolytes: Ability to develop functional additives that create high-performance batteries - Digital EL chemicals: High-level purification and quality management technologies to monitor microscopic particulate contamination

- Food High-performance films: Technological capability to add various functions to create gas-barrier, porous, and multilayer films, etc.

Weaknesses

Weaknesses

- EV/Mobility

High-performance engineering plastics: Global economic and currency risks

Electrolytes: Dependence of raw material supply chain on China - Digital EL chemicals: Supply concerns for raw materials

- Food High-performance films: Concentrated mainly in the domestic market

Opportunities

Opportunities

- EV/Mobility

High-performance engineering plastics: Rising demand for lighter materials

Electrolytes: Rising demand driven by wider use of EVs - Digital EL chemicals: Rapid market expansion and demand for new materials due to semiconductor circuit miniaturization and multilayering

- Food High-performance films: Rising demand in overseas markets

Threats

Threats

- EV/Mobility

High-performance engineering plastics: Shrinking market due to growing adoption of new technologies

Electrolytes: Profit squeeze due to sharp rise in raw material prices - Digital EL chemicals: More local production for local consumption

- Food High-performance films: Medium- and long-term decline in domestic demand

Strategic focus 1

Move from product-focused to market-oriented organization

Promoting the change to a market-oriented business

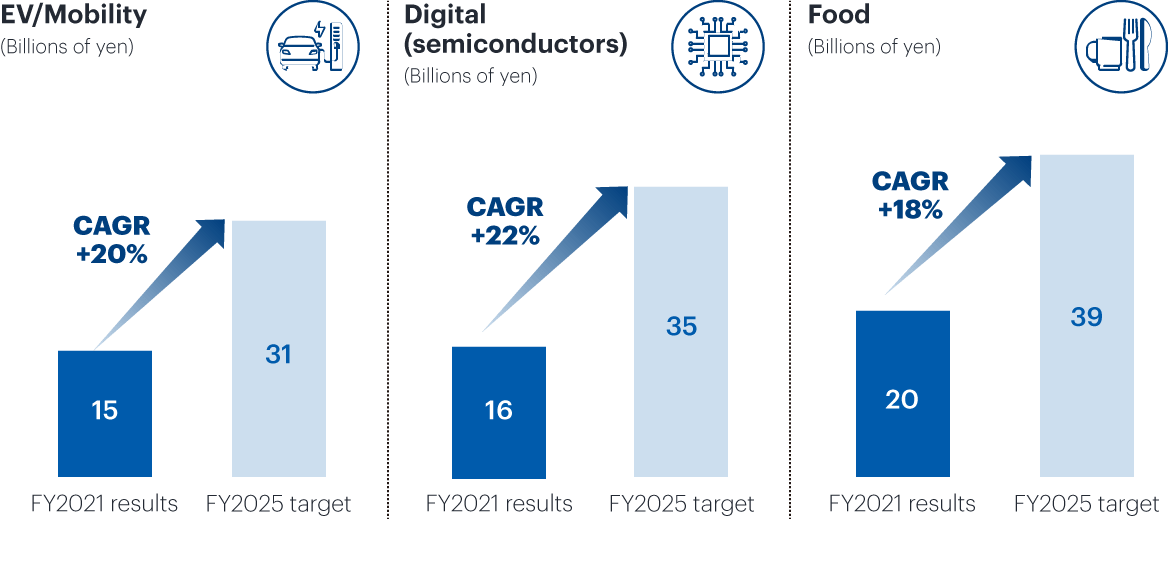

Among our focus markets, we expect particularly strong growth in the EV/Mobility, Digital, and Food markets. With our specialty materials lineup, we can offer multiple products plus the technological capabilities and skills to supply these markets. To grow our businesses at a rate commensurate with market growth, we will move from a product-focused to a market-oriented organization and grow our products globally.

Rather than taking individual products into specific markets as we have done thus far, we will move to an area-based organization that will allow us to leverage our entire product portfolio to reach customers.

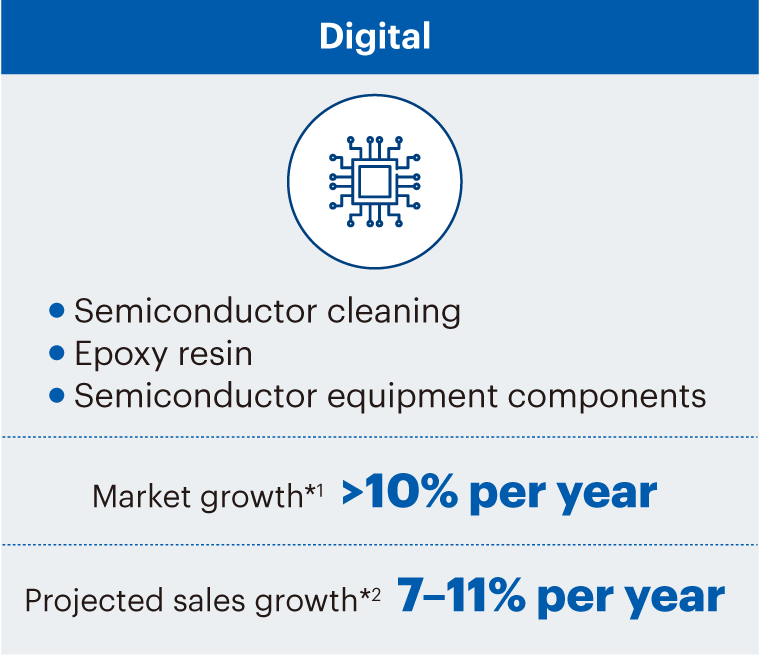

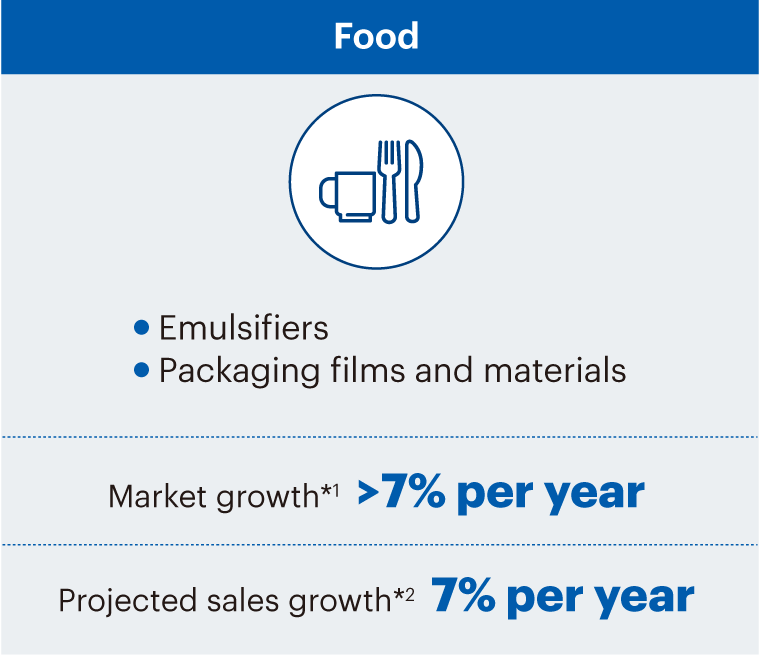

Focus market growth and projected sales growth

- *1Addressable market growth rate in EV, battery, and mobility

- *2Sales growth rates until fiscal 2025 for selected target applications

Strategic focus 2

Grow existing products globally

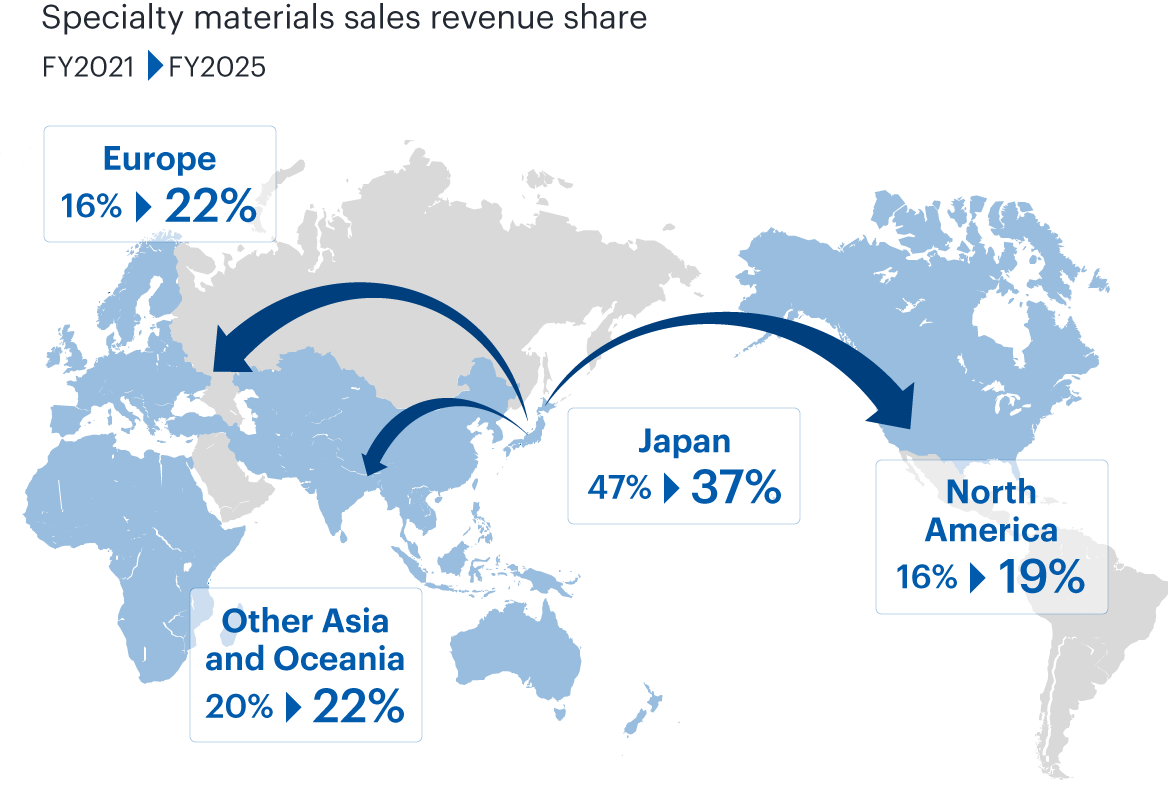

Making the entire product portfolio available globally

To foster growth in expanding overseas markets, we need to make our entire product portfolio available globally. To develop business in global markets, we will transfer significant authority to each region and develop locally based sales activities.

We will work closely with fast-growing customers around the world to grow our business and also promote key account management (one face to the customer).

Strategic focus 3

Build leadership positions in sustainability areas

Further expanding our sustainability position

As we transform under the growth, performance, and sustainability pillar, we are achieving rapid growth through our sustainability brands. The MCG Group has a wide-ranging lineup of products valued for both their superior physical properties and their sustainability. We will further solidify our market position by growing sales of these sustainability brands.

Some of the MCG Group’s sustainability brands

| Brand | Chemistry | Type | ||

|---|---|---|---|---|

| Bio-based route | Biodegradable | Recyclable | ||

| BioPBS | Polybutylene succinate | 〇 | 〇 | |

| DURABIO | Isosorbide-based polycarbonate | 〇 | ||

| SoarnoL | EVOH*1 | 〇 | ||

| Nichigo G-Polymer |

BVOH*2 | 〇 | ||

| GOHSENOL | PVOH*3 | 〇 | ||

- *1Ethylene vinyl alcohol copolymer

- *2Butenediol vinyl alcohol copolymer

- *3Polyvinyl alcohol

DURABIO—a truly innovative bio-based engineering plastic

- Bio-based engineering plastic that combines the advantageous properties of polycarbonate and those of PMMA

- Designed for applications requiring exceptional durable transparency and visual appearance

Example use

Green mobility interior

DURABIO used for the rear heater control panel of the new fuel cell EV MIRAI sold by Toyota Motor Corporation