Industrial Gases

From KAITEKI Report 2023 issued in September 2023

- Grow globally and reinforce our comprehensive capabilities

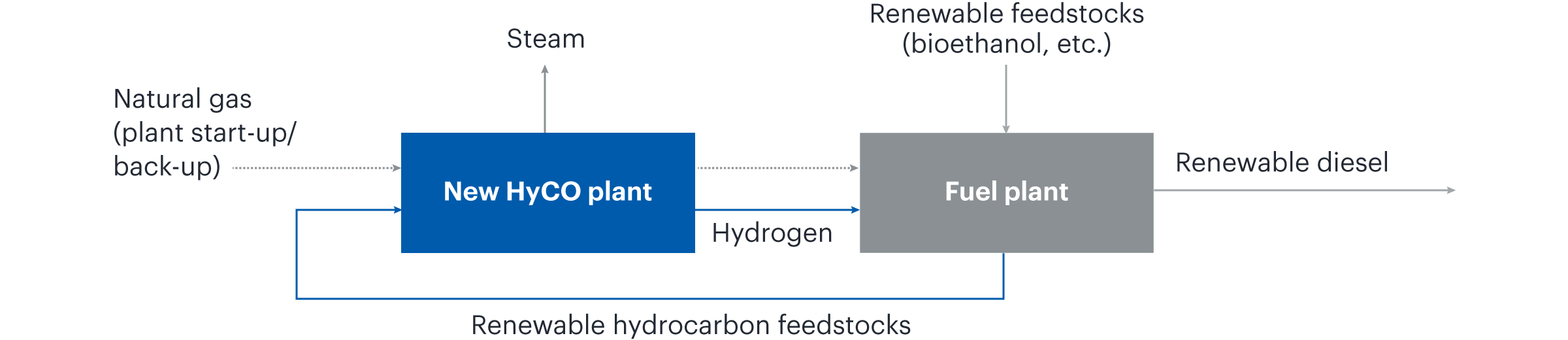

- Promoting the HyCO business as a provider of materials for renewable fuels

Grow globally and reinforce our comprehensive capabilities

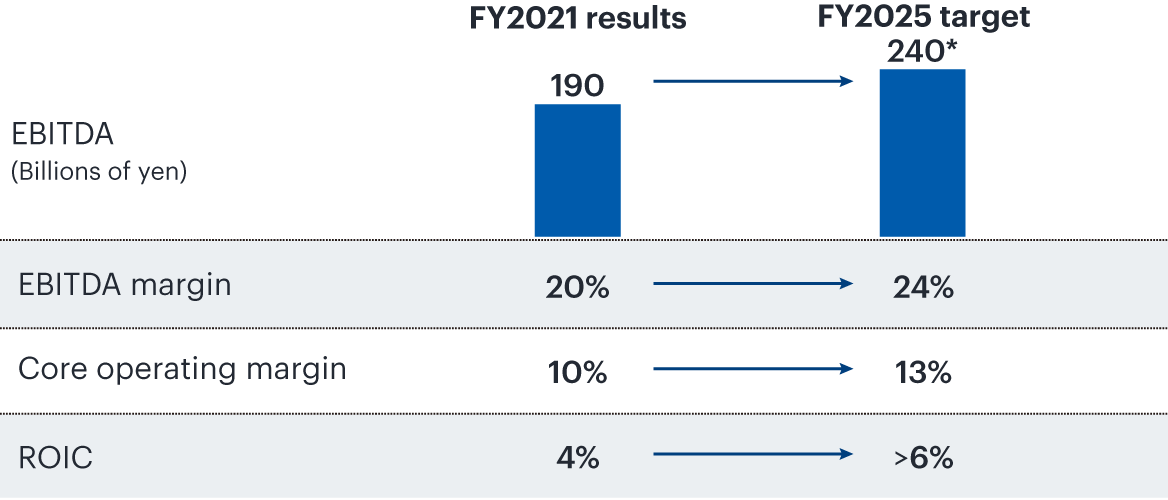

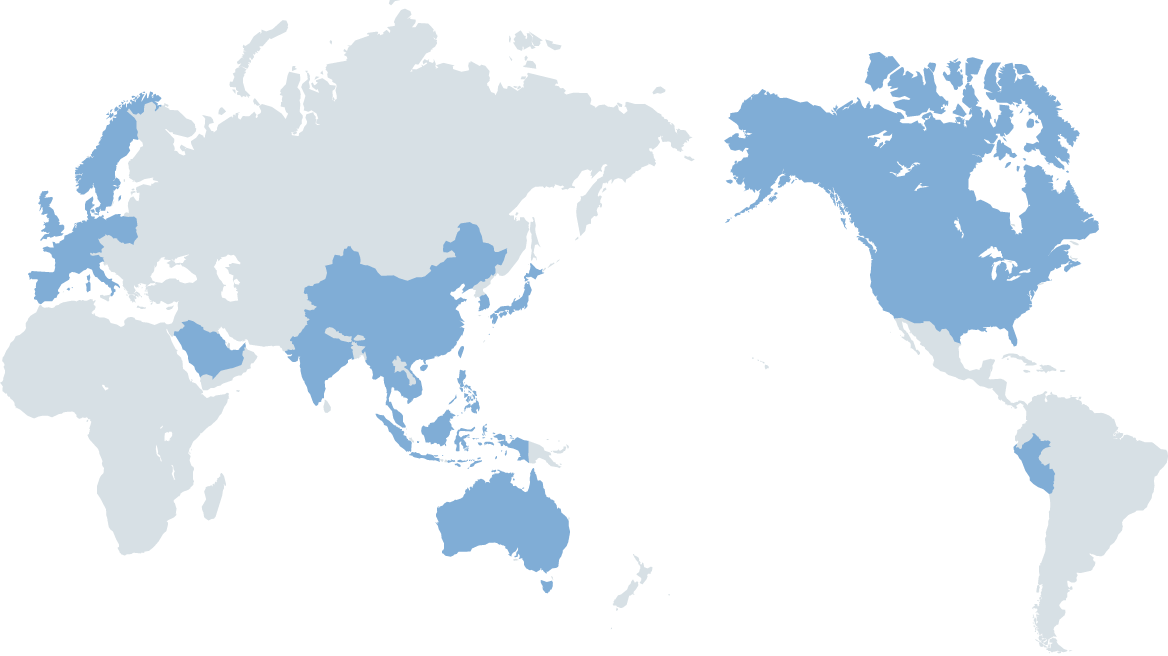

In the industrial gases area, we will act on opportunities for growth worldwide and continue to grow our business in the four global regions (Japan, United States, Europe, and Asia/Oceania) through fiscal 2025. In Japan, we will reorganize our business portfolio, while overseas we aim to improve profit margins and increase productivity, with a focus on gases and equipment for medical applications and electronic materials gases for the semiconductor industry. We will actively explore opportunities to gain more synergies in the fields of R&D and digital technologies and will work to increase corporate value across the entire Group.

Strategic focus

- Grow in the four global regions (Japan, United States, Europe, and Asia/Oceania)

- Improve profit margins

- Strengthen collaboration between the MCG Group and Nippon Sanso Holdings (NSHD) Group

- *Midpoint of the range as disclosed in the medium-term management plan of Nippon Sanso Holdings, rounded up

Applications for high-growth markets

Air separation units (ASUs) that supply highly pure nitrogen in the semiconductor industry

HyCO* plant for hydrogen supply

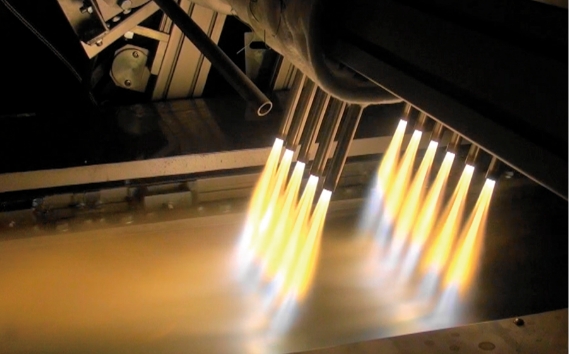

Oxy-fuel burner that contributes to reduced CO2 emissions

- *Also called synthesis gas. Comprises hydrogen (H2), carbon monoxide (CO), or a mixture of both. Produced by separating H2 and CO from natural gas using steam methane reforming (SMR) equipment. The HyCO business provides large-scale supply of H2 and CO to customers in oil refining and petrochemical industries by way of a pipeline.

SWOT analysis

Strengths

Strengths

- Top share of Japan’s industrial gases market and ability to supply to global market

Weaknesses

Weaknesses

- Fluctuating earnings due to electricity costs

Opportunities

Opportunities

- Growing investment opportunities around the world and stable demand in the electronics market and resilient markets (healthcare, food, beverages, etc.)

Threats

Threats

- Growing oligopoly of European and American gas majors in the global market

Promoting the HyCO business as a provider of materials for renewable fuels

NSHD’s U.S. operating company Matheson Tri-Gas, Inc. (Matheson) has signed a long-term supply agreement to meet hydrogen requirements for renewable diesel production at a 75,000 barrel per day (bpd) refinery in Mobile, Alabama owned by Vertex Energy, Inc., in addition to supplying hydrogen from an existing facility. A newly established HyCO facility will have a hydrogen production and supply capacity exceeding 30 million standard cubic feet per day (mmscfd) using renewable hydrocarbon feedstocks (including bio-naphtha and other bio-offgases) from Vertex’s renewable diesel production.

This initiative demonstrates the NSHD Group’s commitment to carbon neutrality through gas supply for commercially sound renewable energy projects and represents a significant additional dimension for the NSHD’s Global HyCO business footprint. The NSHD Group will continue to actively explore target customers and projects, and through careful scrutiny will continue to realize business growth and contribute to a carbon-neutral society.