Health Care

From KAITEKI Report 2023 issued in September 2023

Strengthening the pipeline and maximizing product value

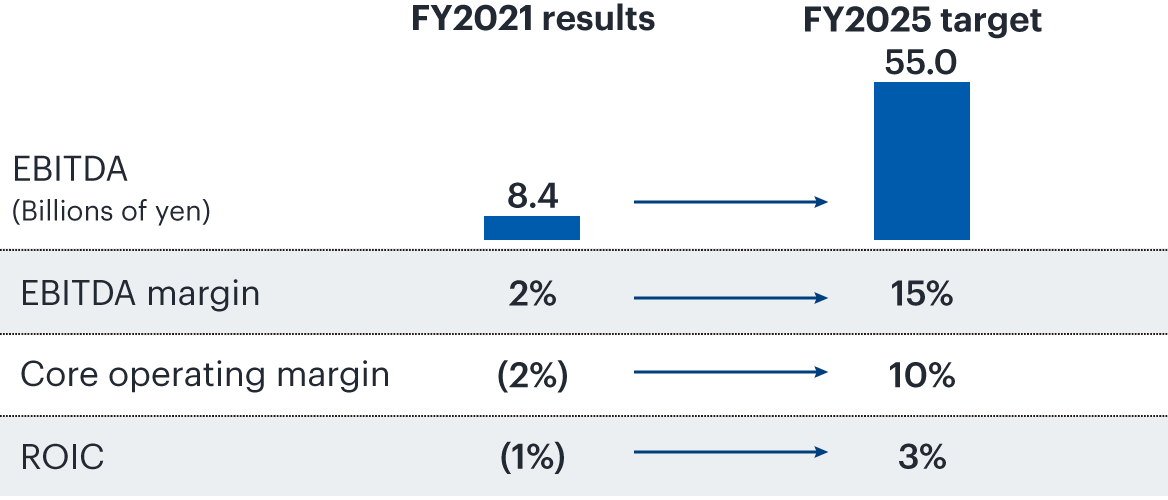

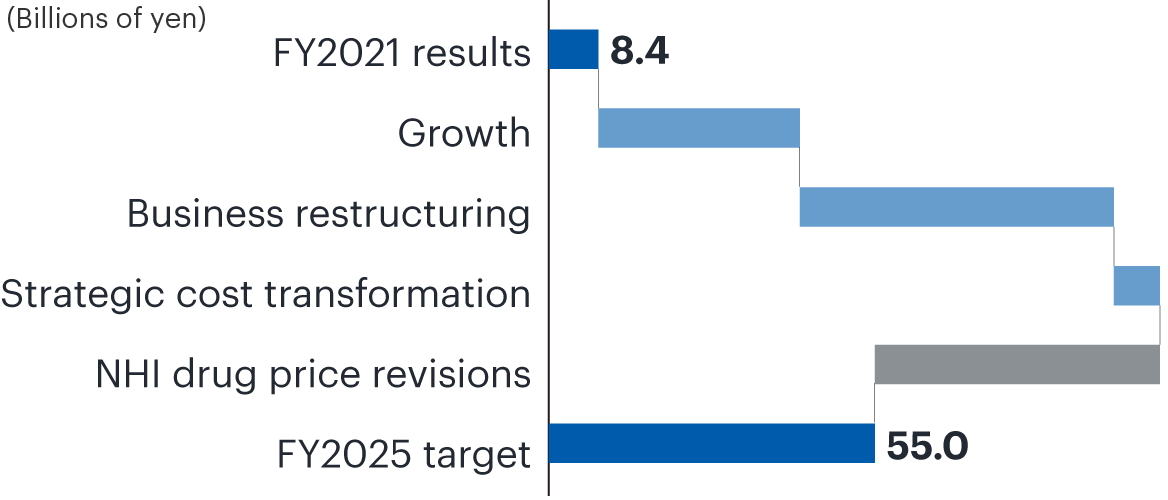

To achieve our fiscal 2025 targets, we are focusing on (1) maximizing the value of priority products in Japan and the United States and (2) strengthening partnering and establishing new sales and development alliances. We restructured our business in fiscal 2022, including withdrawal from the business operated by Medicago Inc. that was developing a vaccine against COVID-19. We will now focus R&D spending on indications in the core areas of central nervous system, immuno-inflammation, and oncology, with the goal of strengthening our pipeline and maximizing product value.

Strategic focus

- Advance precision medicine through upgraded R&D processes

- Focus innovation development on rare diseases and continue to invest in a new pipeline

- Leverage partnerships for development and sales

SWOT analysis

Strengths

Strengths

- New drug creation capabilities in the pharmaceuticals business

- Strong presence in priority drug markets including central nervous system, immuno-inflammation, and diabetes and kidney

Weaknesses

Weaknesses

- Delayed expansion into global markets

Opportunities

Opportunities

- Demand for provision of diverse healthcare solutions

- Increasingly diverse drug discovery activities due to technological advances

- Unmet medical needs

Threats

Threats

- Declining probability of success with drug discovery

- Increasing R&D expenditures

- Government measures to control healthcare expenditures, generic drugs entering the market

New treatment option for ALS patients

The oral suspension formulation of edaravone was approved as a treatment for amyotrophic lateral sclerosis (ALS) in the United States in May 2022, in Canada in November, in Japan in December, and in Switzerland in May 2023.

This oral suspension formulation of edaravone contains the same active ingredient as the intravenous infusion formulation RADICUT (U.S. product name: RADICAVA). We undertook its development with the aim of reducing burdens on ALS patients such as injection pain and outpatient visits. Previously, intravenous infusion was the only available route of administration, but now there is a new treatment option.

- Launched

- Global (FY of U.S. launch)

- Japan, China

| Area | Focus | Targeted indications | Key markets | MCG Group’s key growth products | Launch plans for main pipeline programs | |||

|---|---|---|---|---|---|---|---|---|

| FY2022 | FY2023 | FY2024 | From FY2025 | |||||

| Central nervous system | Development, sales | ALS, Tardive dyskinesia |

U.S., Japan | RADICAVA DYSVAL | MT-1186 ALS (oral suspension) (U.S., Canada) MT-5199 Tardive dyskinesia (Japan) | MT-1186 ALS (oral suspension) (Japan)*2 | ND0612 Parkinson’s disease (global) | MT-0551 Myasthenia gravis (Japan) |

| Immuno-inflammation | Development, sales | Inflammatory bowel disease, Erythropoietic protoporphyria |

U.S., Japan | STELARA MT-7117 |

MT-0551 IgG4-related disease (Japan) MT-7117 Erythropoietic protoporphyria (EPP), X-linked protoporphyria (XLP) (global) |

|||

| Diabetes and kidney | Sales | Type 2 diabetes, Chronic kidney disease (CKD) associated with type 2 diabetes |

Japan | MOUNJARO CANAGLU | TA-7284 CKD associated with type 2 diabetes*1 (Japan) MP-513 Type 2 diabetes (China) | TA-7284 OD tablets Type 2 diabetes, CKD associated with type 2 diabetes*1 (Japan) | ||

| Oncology | Development | Rare cancers | U.S., Japan | MT-2111 | MT-2111 Relapsed/refractory diffuse large B-cell lymphoma (DLBCL) (Japan) | |||

- *1CKD associated with type 2 diabetes, but excludes patients with end-stage renal failure or undergoing dialysis

- *2Approved in Switzerland