Corporate Governance

- Basic Approach to Corporate Governance

- Governance System

- Standards for Independence of Outside Directors

- Policy on Deciding Compensation for senior management

Basic Approach to Corporate Governance

Upholding “We lead with innovative solutions to achieve KAITEKI, the well-being of people and the planet” as its Purpose, the Mitsubishi Chemical Group Corporation (MCG) Group aims to provide value to all stakeholders (Value) through better innovation (Science) and to contribute to healthy living, the sustainability of society, and the Earth (Life).

For Realizing KAITEKI, MCG shall establish a system to enhance both the soundness and efficiency of business administration, improve the transparency of its business administration through suitable disclosure of information and dialogue with stakeholders, and endeavor to establish a better suitable corporate governance system.

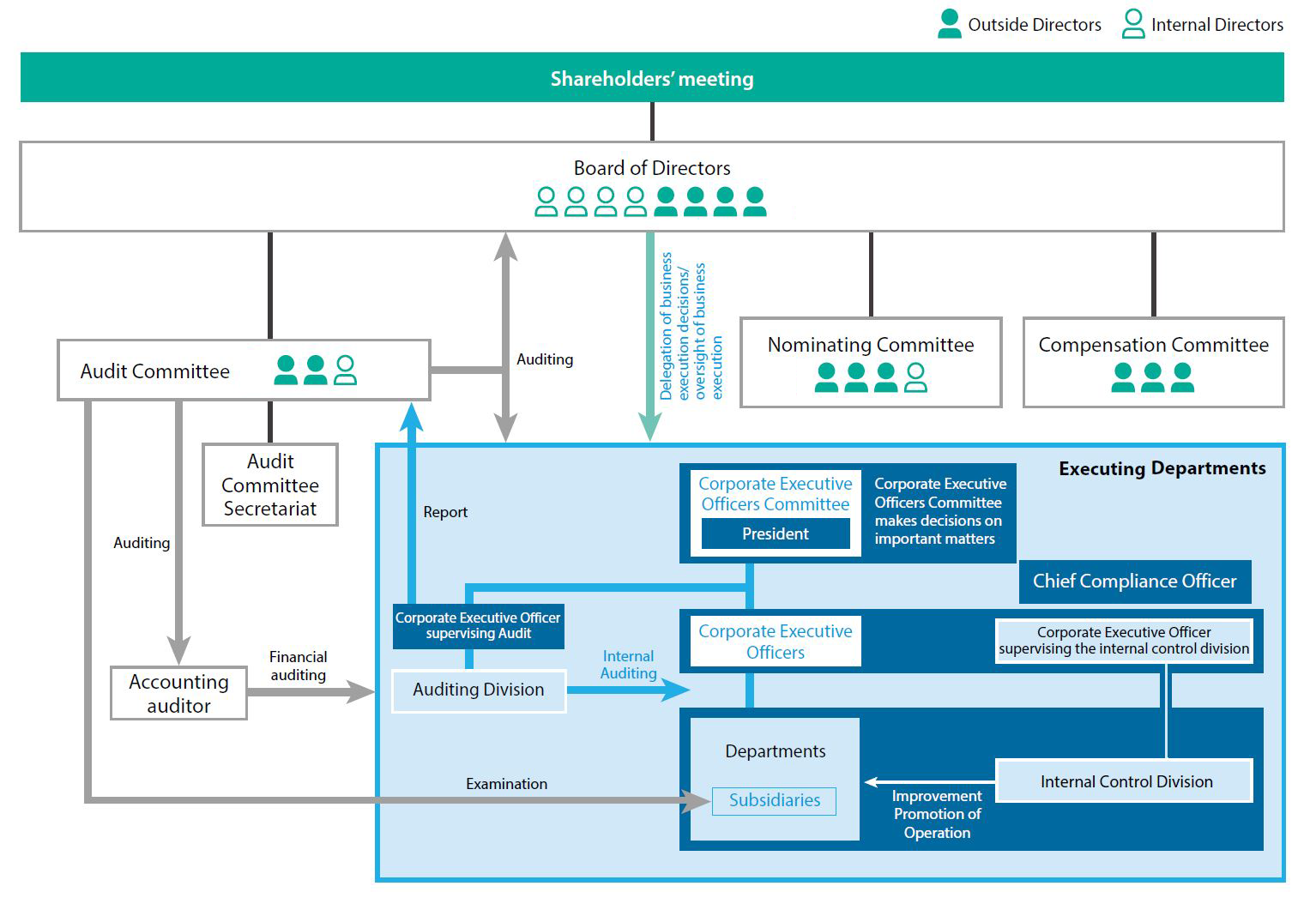

Governance System

MCG , as a company with a nominating committee, etc., separates functions for the supervision and execution of business in a bid to enhance management transparency and openness, strengthens management oversight functions, and improves management agility by accelerating decision-making. While management supervision is now undertaken by the Board of Directors and three committees comprised of the Nominating Committee, Audit Committee, and Compensation Committee, corporate executive officers make business decisions and are in charge of business execution.

History of strengthening Corporate Governance

| Date | Initiatives | Objective |

|---|---|---|

| June 2013 | Appointment of an outside director | To strengthen the system of management supervision |

| June 2014 | Appointment of a foreign director | To improve diversity in directors |

| June 2015 | Appointment of a female director Transition to a company with a nominating committee, etc. |

To improve diversity in directors To enhance management transparency and fairness, to strengthen management supervision functions |

| June 2016 | Increase number of outside directors | To strengthen management supervision functions |

| June 2021 | Appointment of the leading independent outside director | To improve the independence of the Board of Directors, to strengthen cooperation between executive and outside directors |

Roles and Responsibilities

Board of Directors

The Board of Directors determines basic management policies (group philosophy, medium-term management plans, annual budgets, etc.), and supervises the overall management. In principle, the Board of Directors delegates authority to corporate executive officers to make business execution decisions based on the basic management policies.

In order to establish the Group’s basic management policies and oversee management appropriately, MCG appoints directors from a multifaceted viewpoint by defining expected universal skills—corporate management, global business, and risk management—and skills required for medium- to long-term management—legal affairs, compliance, finance, our industry and related industries, and technology/science/digital knowledge. In addition, in order to strengthen the supervisory function of the Board of Directors, the majority of Directors do not concurrently serve as Executive Officers, and we have established a system to ensure appropriate supervision of business execution.

That being said, the Articles of Incorporation stipulate that there shall be no more than 20 directors at one time. As of June 27, 2023, there are a total of 8 directors (of which 2 directors are also corporate executive officers), including the 4 outside directors.

With a view to strengthen the independence of the Board of Directors and strengthening cooperation between executive officers and outside directors, MCG appoints the leading independent outside director by mutual selection of outside directors. Leading independent director collects the opinions of outside directors and hold discussions with the chairman of the Board of Directors and the president of executive officers, and presides over a conference body consisting only of outside directors.

Constitution of the Board of Directors

| Name | Position | General Skills*1 | Specialty Skills*2 | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Management | Global Business | Risk Management | Legal and Compliance | Finance | Industry and Related Business | Technology, Science and Digital | ||

| Jean-Marc Gilson | Director of the Board(Corporate Executive Officer) | ● | ● | ● | ● | ● | ||

| Ken Fujiwara | Director of the Board(Corporate Executive Officer) | ● | ● | ● | ● | |||

| Glenn Fredrickson | Director of the Board | ● | ● | ● | ● | |||

| Nobuo Fukuda | Director of the Board | ● | ● | ● | ||||

| Takayuki Hashimoto | Independent Outside Director of the Board | ● | ● | ● | ● | |||

| Chikatomo Hodo | Independent Outside Director of the Board | ● | ● | ● | ● | |||

| Kiyomi Kikuchi | Independent Outside Director of the Board | ● | ● | ● | ||||

| Tatsumi Yamada | Independent Outside Director of the Board | ● | ● | ● | ||||

- *1 General skills are skills that are universally required of Directors of the Board of MCG, and “Global Business” and “Risk Management” are common skills required of all directors of the Board.

- *2 Specialty skills are skills that are required from a medium- to long-term perspective, and are professional skills that each Director of the Board has particular strengths.

Nominating Committee

The Nominating Committee nominates candidates for directors and executive officers. As of June 27, 2023, the Nominating Committee consists of 4 members including 3 outside directors.

An outside director serves as the chairperson to enhance the transparency and soundness of the nominating process.

Nominating Committee (as of June 27, 2023)

| Outside Directors | Inside Director | |

|---|---|---|

| Chairperson |

Takayuki Hashimoto |

|

| Members |

Chikatomo Hodo |

Ken Fujiwara |

Audit Committee

The Audit Committee is responsible for auditing the execution of duties by the corporate executive officers and directors , preparing audit reports, gathering information from the Representative Executive Officer, etc., establishing a system for cooperation with the Internal Audit Department,reviewing the Group’s internal control system and conducting audits and investigations of the corporate group. As a general rule, the committee meets once a month. As of June 27, 2023, the Audit Committee consists of 3 members including 2 outside directors. Together with selecting full-time members, the audit department that performs internal audits and the internal control department that formulates and promotes policies on establishing internal control systems collaborate closely to enhance the audit system administered by the Audit Committee. In consideration of transparency and fairness in the audit, the chairperson of the committee is the outside director.

Tatsumi Yamada is qualified as Certified Public Accountant, so he has considerable knowledge of finance and accounting.

Audit Committee (as of June 27, 2023)

| Outside Directors | Inside Director | |

|---|---|---|

| Chairperson |

Tatsumi Yamada |

|

| Members |

Kiyomi Kikuchi |

Nobuo Fukuda |

Compensation Committee

The Compensation Committee designs the compensation system for directors and corporate executive officers and determines the individual amount of compensation for each director and corporate executive officer at the Company. As of June 27, 2023, the Compensation Committee consists of 3 outside directors.

An outside director serves as the chairperson to enhance transparency and fairness of the decision-making process.

Compensation Committee (as of June 27, 2023)

| Outside Directors | Inside Directors | |

|---|---|---|

| Chairperson | Chikatomo Hodo |

|

| Members |

Takayuki Hashimoto |

― |

Corporate Executive officers

The corporate executive officers decide the execution based on basic management policies (medium term business strategies and annual budgets, etc.).

Regarding important matters in the management of the Group, deliberations are made at the corporate executive officers, which is the council by the corporate executive officers. In addition to determining the division of duties of each corporate executive officer for other matters, we make it appropriate and efficient decision-making by clarifying the authority to decide the corporate executive officer in charge.

Corporate Executive Officers Committee

The Corporate Executive Officers Committee is composed of all corporate executive officers, deliberates and decides on important matters concerning the management of the Company and the Group, and also monitors the Group’s business based on the medium-term management plan, annual budget etc.

That being said, the Member of the Audit Committee can attend the Corporate Executive Officers Committee at any time to express freely.

Standards for Independence of Outside Directors

The Company shall elect those as Outside Directors who do not fall under any of the following and are capable of overseeing the Company’s management from a fair and neutral standpoint, free of a conflict of interest with general shareholders.

- 1.Related party of the Company

-

(1)Person engaged in execution of operation of the MCG Group (Executive Director, Corporate Executive Officer, Executive Officer, Manager, employee, partner, etc. The same shall apply hereafter.)

(2)A person who has been engaged in execution of operation of the MCG Group in the past 10 years - 2.Major shareholder

- A person who directly or indirectly holds 10% or more of MCG’s total voting rights or a person engaged in execution of operation of a company that directly or indirectly holds 10% or more of MCG’s total voting rights

- 3.Major business partner

-

(1)A person engaged in execution of operation of a company*1 whose major business partner includes MCG and Group Major Subsidiaries (Mitsubishi Chemical Corporation, Mitsubishi Tanabe Pharma Corporation, Life Science Institute, Inc., and Nippon Sanso Holdings Corporation. The same shall apply hereafter.)

(2)A person engaged in execution of operation of a major business partner*2 of MCG and Group Major Subsidiaries - 4.Accounting Auditor

- Accounting Auditor of the MCG Group or an employee thereof

- 5.Transaction as an individual

- A person who receives money and other financial benefits of 10 million yen or more per year from any of MCG and Group Major Subsidiaries

- 6.Donation

- A person who receives a donation or financial assistance of 10 million yen or more per year from any of MCG and Group Major Subsidiaries or a person engaged in execution of operation of a company that receives a donation or financial assistance of 10 million yen or more per year from any of MCG and Group Major Subsidiaries

- 7.Reciprocal assumption of the position of Director

- A person engaged in execution of operation of a company that has elected any of the Directors and employees of the MCG Group as its Director

- 8.Close relatives, etc.

-

(1)Close relatives, etc. of a person engaged in execution of important operations of the MCG Group (spouse, relatives within the second degree of relationship or any person who shares the same livelihood. The same shall apply hereafter.)

(2)Close relatives, etc. of any person who meets the definition of items 3 through 7 above

- *1If the said business partner receives from MCG and Group Major Subsidiaries an amount equivalent to 2% or more of its annual consolidated net sales in the latest fiscal year, this company shall be considered as the one whose major business partner includes MCG.

- *2If MCG and Group Major Subsidiaries receives from the said business partner an amount equivalent to 2% or more of MCG’s annual consolidated net sales in the latest fiscal year or the said business partner loans to the MCG Group an amount equivalent to 2% or more of MCG’s total consolidated assets, the said business partner shall be considered as a major business partner of MCG.

- *3The party is deemed to fall under the items 3. to 7. when the relevant conditions were met any time in the past three years.

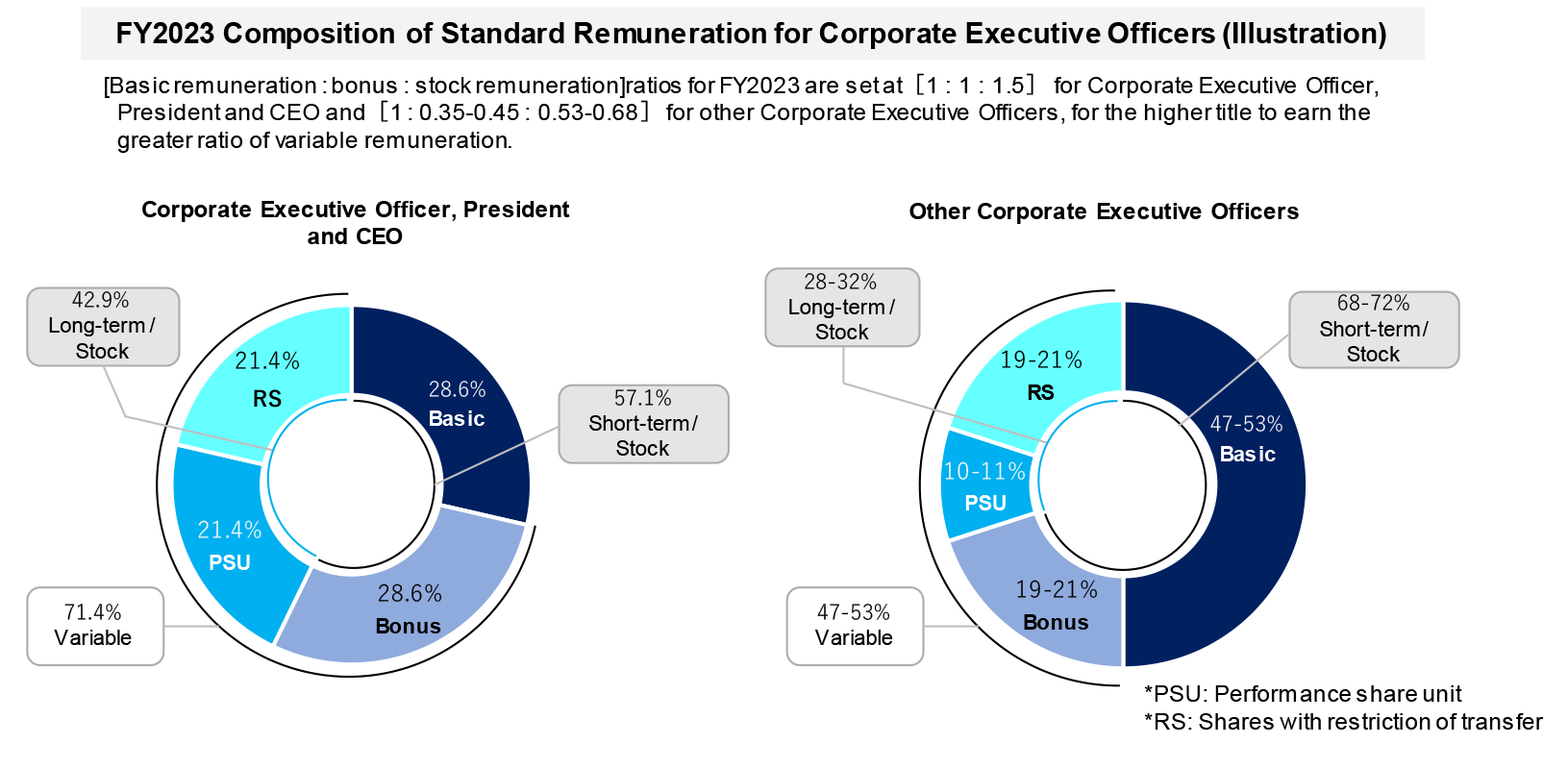

Policy on Deciding Compensation for Senior Management

Systems for Directors and for Corporate Executive Officers are separate, and remuneration is determined by the Compensation Committee based on the following concepts:

Basic Policy on Decision on Directors’ Compensation

- Given their role of overseeing and auditing management of the Company from an independent and objective standpoint, remuneration for Directors shall be mainly consist of basic remuneration (fixed remuneration). Outside Directors, who are expected to supervise and provide advice on management from the viewpoint of shareholders and investors in order to enhance corporate and shareholder value, shall be paid Stock remuneration not linked to performance in addition to basic remuneration.

- In order to secure personnel suitable for executing the responsibilities of Directors of the Company with a Nominating Committee, etc., the level of remuneration shall be determined by considering the levels of other companies, expected roles/functions, hours required to execute their duties, and other factors.

Basic Policy on Decision on Corporate Executive Officer Remuneration

- A remuneration plan shall be the one that makes officers conscious of the integrated practice of the three axes (MOS/MOT/MOE) for realizing the MCG Group’s Purpose.

- A remuneration plan shall be the one that effectively functions as an incentive to enhance short-term and medium and long-term performance and improve sustainable corporate value and shareholder value.

- The level of remuneration shall be a level competitive enough to acquire and keep good management personnel who lead the sustainable growth of the MCG Group.

- Remuneration shall be determined through a fair and reasonable decision-making process that can fulfill accountability for all stakeholders including shareholders, customers, and employees.

Composition of the Remuneration of Corporate Executive Officers

In light of the basic policy, the remuneration of corporate executive officers is set as follows.

Related Information